Residual Claim on Assets: Stockholders & Liquidation

If you own shares of a company, you may be wondering if you would get paid if the company went bankrupt tomorrow. Who determines what your share of the assets will be in a liquidation scenario? The answer is an important concept known as residual claims.

Residual Claim Definition

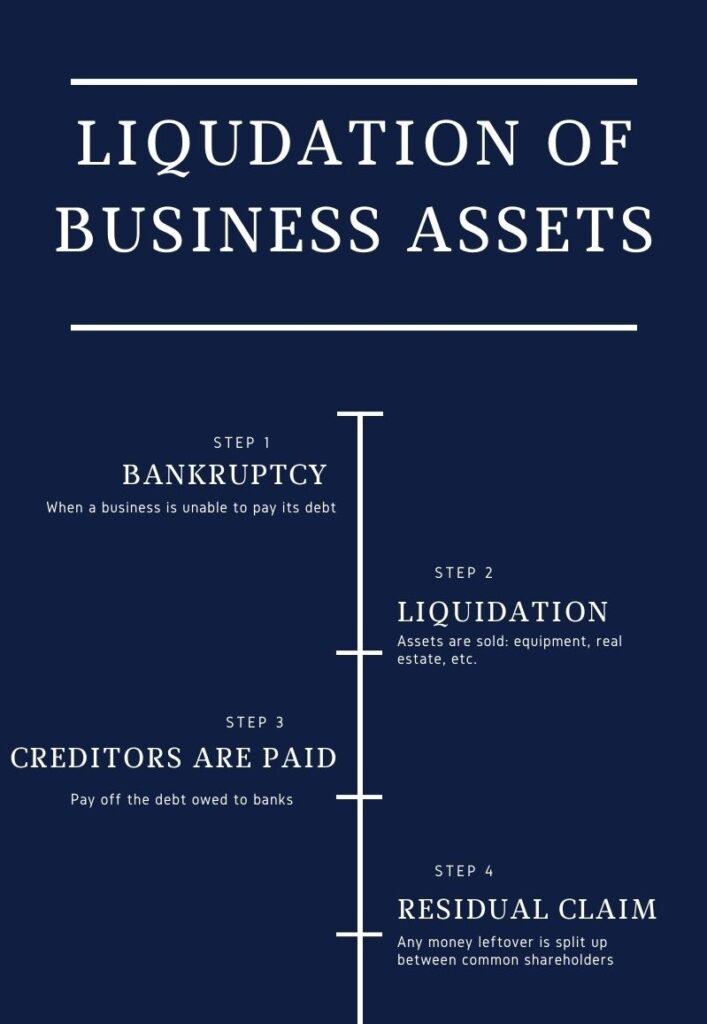

The term residual claim refers to a stockholders’ right to its share of earnings in a liquidation scenario after all debt obligations have been paid.

Somebody who has common shares of a company has a residual claim to its assets, meaning that if the company went bankrupt and was forced to liquidate its assets, debt to banks and other creditors would be satisfied first, and anything leftover would be split up amongst the common shareholders who have a residual claim.

It is noted that residual claims are sometimes referred to as “equity claims”.

Residual Claim Example

Pretend you are a 50% common shareholder of a landscaping business with debt on several pieces of high-end equipment. The business also owns a commercial garage where it stores its equipment, however there is no debt associated with the real estate. During an economic recession, you begin losing customers and aren’t able to make the loan payments on the equipment which leads to bankruptcy. All of the business’s assets would be liquidated. After selling the equipment and real estate, you could pay off the debt owed on the equipment. There would likely be money leftover from the sale of the real estate. As a common shareholder, you would have a residual claim to the leftover money.

Here is what your balance sheet would look like before the liquidation:

Assets:

Equipment: $550,000

Real Estate: $450,000

Liabilities:

Debt on landscaping equipment: $500,000

After liquidating the equipment and real estate, you would receive $1,000,000 in cash. After paying off the $500,000 in debt on the landscaping equipment, $500,000 would be split up between the common shareholders. Since in this scenario you own 50% of the common shares, you would personally have a residual claim to $250,000.

It’s important to note that in many bankruptcy scenarios, there usually isn’t money leftover. In fact, that’s probably the reason why they are going bankrupt in the first place. The shareholders rarely get a large payout after a liquidation event.

Conclusion

Residual claims are an important concept to know if you’re a common shareholder of a company. If for whatever reason the company had to liquidate its assets, its always good to know what percentage of the assets you would be entitled to.

Related Terms

Bankruptcy – A legal proceeding that involves an individual or corporation that is unable to repay its debts.

Assets – Property owned by an individual or business with economic value. Assets are reported on a businesses balance sheet.

Liabilities – Something that is owed to another individual or business. They are also reported on the balance sheet.

Common Shareholder – An individual who owns at least one common share of a business. They can vote on certain issues and are entitled to receiving common dividends.