Investment Banking Career Path

Investment banking is one of the most rewarding careers on the planet. Although investment bankers can earn over $100,000 per year right out of college, the field is highly competitive. Read about investment banking jobs, career progression, salary information, and how to become an investment banker.

What Is investment Banking?

Investment banking is a specific division of banking that helps companies, governments, and other entities raise capital to finance the various activities required for growth. Investment bankers often advise their clients regarding corporate-level transactions such as initial public offerings (IPO) and bond issuance. In addition to helping raise capital, investment bankers also assist with mergers and acquisitions.

Although investment banking careers come with incredible pay, many investment bankers work over 80 hours per week. For this reason, this demanding and competitive career path is not for everyone.

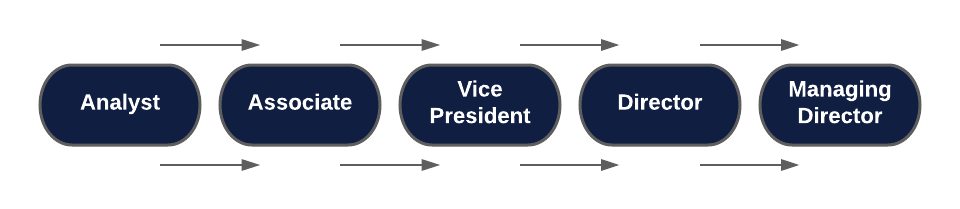

Investment Banking Career Path

- Entry Level – Investment Banking Analyst

- Mid Level – Investment Banking Associate

- Senior Level – Vice President, Director, & Managing Director

Entry Level – Investment Banking Analyst

Becoming an analyst is the first step in starting a career in investment banking. Because analysts are the lowest position in the investment banking hierarchy, its their job to do whatever it takes to support their superiors in closing deals. This includes completing tasks such as putting together presentations, financial analysis/underwriting, communicating with clients, and random administrative tasks.

Analyst positions in investment banking are highly selective, however, a bachelor’s degree from a top ranked school and/or an MBA can help you get into an interview.

Analyst Salary

Investment banking analysts earn the highest salary out of any other entry level finance job. Fresh out of an undergraduate degree, analysts at large banks in the United States can earn $170,000 in total annual compensation, with an average base salary of about $90,000 and the rest being bonuses.

When working at smaller, more regional bank, or when working at an investment bank in a different country, salaries tend to be about 25% lower.

Yes, the annual salary of an analyst is well above average for an entry level job, but keep in mind that analysts will often work 15+ hour days.

Analyst Qualifications

- Bachelor’s degree in Accounting, Finance, Economics, or similar

- MBA preferred but not required

- Excellent GPA

- Relevant work experience such as an investment banking internship

Mid Level – Investment Banking Associate

Becoming an associate is the next step in an investment banking career path. Analysts and associates often perform a lot of the same duties, however, associates have more responsibility, acting as a liaison between analysts and senior bankers. Associates often assign analysts tasks and review their work.

Top performing analysts will be promoted to investment banking associates after about 2-3 years. It’s also possible to become an associate after completing a top ranked MBA program.

Associate Salary

Investment banking associates in the United States typically earn about $300,000 in total annual compensation, with an average base salary of about $150,000 and the rest being bonuses. Salaries vary significantly, with total annual compensation ranging anywhere from $200,000 to $400,000.

When employed at a smaller bank or when working in a country outside of the United States, salaries can be about 20-25% lower on average.

Associate Qualifications

- 2-3 years of experience as an investment banking analyst

- MBA from a top ranked school or a similar advanced degree

Senior Level – Vice President, Director, & Managing Director

Senior level investment bankers include vice presidents, directors (sometimes referred to as senior vice presidents), and managing directors. These senior bankers are primarily engaged in originating deals, maintaining relationships, and other sales based activities.

Typically, investment bankers will be at the associate level for 4-5 years before being promoted to vice president, however, it varies by bank and can sometimes be much longer.

Once you are a vice president, the time it takes to be promoted to director or managing director varies substantially. Only the best of the best will be promoted to director or managing director roles in investment banking. It is noted that individuals in these positions may not even have a background in investment banking. In fact, it is very common to enter one of these roles with a background in corporate executive management or something similar.

Senior Investment Banker Salaries

Senior investment bankers such as vice presidents, directors, and managing directors make the most money in an investment banking career path, however, salaries range a lot depending on factors such as location, bank size, and years of experience. Here are the typical salaries for senior investment bankers in the United States:

- Vice President – Base salary of $250,000 with total annual compensation of about $500,000

- Director – Base salary of $375,000 with total annual compensation of about $750,000

- Managing Director – Base salary of $500,000+ with total annual compensation of $1,000,000+

How To Become an Investment Banker

If you’re up for the challenge of trying to become an investment banker, there are a few things you can do to maximize your chances of getting an analyst position right out of college.

Getting excellent grades, a related internship, and/or an MBA can give you a better chance of securing an entry level job in investment banking. Some people applying for analyst positions will even get a CFA certification to stand out from the crowd.

Networking is also extremely important, so make sure to start a LinkedIn profile as soon as possible and start connecting with recruiters and industry professionals.

What Skills Are Required?

- Presentation Skills – Investment bankers need to be comfortable with presenting complex ideas to highly demanding clients

- Analytical Skills – Analyzing financial statements, identifying risk-return tradeoffs, and backing up your findings to senior management is all part of the job. Investment bankers must have exceptional analytical abilities.

- Sales Ability – This is especially true once you reach the vice president level. The most successful people in investment banking are excellent at selling.

- Entrepreneurial Skills – The primary goal of investment banking is to help companies grow. Great investment bankers can easily identify new business opportunities, even if the company being helped is in an unfamiliar industry.

Ready for a Career in Investment Banking?

If you’re interested in pursuing one of the highest paying and most competitive careers in finance, there is no better time to start preparing than right now.

The career path outlined in this guide is the most common, but it’s important to note that other career paths exist in investment banking. A lot of people will be an investment banker for a 2-3 years and then leverage their experience into a position at a private equity firm.

If you have any questions regarding a career in investment banking, don’t hesitate to contact us.