How to Calculate MOIC – Multiple on Invested Capital

Table of Contents

MOIC Definition

Multiple on Invested Capital (MOIC) is a financial ratio that measures performance of an investor’s capital. It is frequently used by private equity firms so they can see the gross multiple of how much money they have made relative to how much money they have invested. It is worth noting that MOIC takes into account both realized and unrealized gains on investments.

Formula

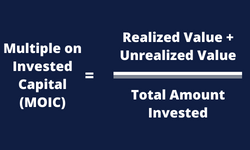

The formula for calculating MOIC is:

(Realized Value + Unrealized Value) / Total Amount Invested

A higher ratio means the investment is more profitable whereas a lower ratio means the investment is less profitable.

Keep in mind that time is not factored into the MOIC formula. This is important because it can sometimes be misleading when comparing the performance of your investment to other investments that were made years before. This is why many investors apply the MOIC calculation to their entire portfolio.

How to Calculate MOIC

To calculate Multiple on Invested Capital, you need three things: the value of realized gains, the value of unrealized gains, and the total dollar amount of money invested.

Example #1:

Let’s pretend a private equity firm originally invested $1 million into a company and the current value of the investment is $5 million.

| Realized Value | $0 |

| Unrealized Value | $5,000,000 |

| Total Amount Invested | $1,000,000 |

$5,000,000 / $1,000,000 = 5x

In this example, MOIC is 5x due to the unrealized value being 5 times the amount invested.

Example $2:

Here’s a slightly more complicated example. Let’s pretend that an individual invested $500,000 into a small business. Two years later, they have already realized returns of $900,000 and the value of their initial investment is now $4,000,000.

| Realized Value | $900,000 |

| Unrealized Value | $4,000,000 |

| Total Amount Invested | $500,000 |

For this example, you first need to add the realized value of $900,000 to the unrealized value of $4,000,000. Then you must divide that amount by the initial investment of $5,000,000.

($900,000 + $4,000,000) / $500,000 = 9.8x

The investor earned a Multiple on Invested Capital of 9.8x.

MOIC Calculator

Although the formula for calculating MOIC is fairly simple, use the following calculator for your convenience:

MOIC vs. IRR

IRR, which stands for Internal Rate of Return, is another measure of an investment’s performance. The biggest difference between the two is that MOIC measures how much an investment has already generated whereas IRR is an estimate of how much an investment is expected to generate. IRR takes into account time whereas MOIC does not.

Conclusion

MOIC is an important concept in finance, particularly within private equity. Although the ratio has its limitations, it’s a decent way to measure a fund’s performance overtime. A firm should consider using MOIC in conjunction with IRR to obtain a comprehensive understanding of the investment at large.

Getting a job in private equity is highly competitive and you will likely need to have background in investment banking. Some people will even begin a career in commercial banking and will exit into private equity after a decade or so of experience.