Career Paths in Corporate Finance

Is it your dream to become the CFO of a company one day? If so, a career in corporate finance may be for you. Explore common career paths with the most up-to-date corporate finance salary information.

What is Corporate Finance?

Corporate finance is any business division that manages the financial activities for a firm. Examples of jobs in corporate finance are accountants, financial analysts, treasurers, and business analysts. All types of businesses can have a corporate finance division, from manufacturing companies to investment and commercial banks.

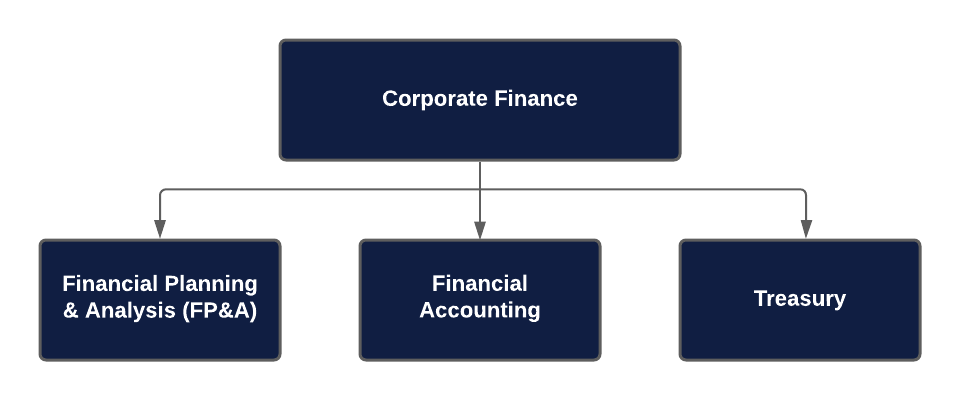

Corporate Finance Career Paths

Many career paths exist in corporate finance because there are so many different types of jobs in the field. Here are three of the most common career paths in corporate finance. Each of these career paths can potentially lead to a position as chief financial officer.

Career Path #1: Financial Planning & Analysis (FP&A)

The financial planning and analysis (FP&A) department supports a business by planning and budgeting, financial modeling and forecasting, and management and performance reporting. Here is the typical career path in FP&A:

Entry Level: Financial Analyst

Financial analysts are responsible for financial planning and creating models and forecasts by analyzing business performance and market conditions. The primary tasks of an analyst involve data mining, model building and maintenance, as well as cooperating with various stakeholders.

According to the Bureau of Labor Statistics, financial analysts earn a median salary of $81,590 annually. In order to become a financial analyst, a bachelor’s degree in finance or accounting is often required, with previous finance experience such as an internship preferred.

It’s common for financial analysts to earn a salary between $50,000 and $70,000 annually plus bonuses right out of college. Once you have 3-5 years of experience as a financial analyst, it’s common to be promoted to a senior analyst position. Senior analysts run projects and direct junior analysts and tend to earn a salary between $65,000 and $85,000 annually plus bonuses.

Mid-Level: FP&A Manager

FP&A managers are responsible for leading multiple analysts and senior analysts to ensure that processes such as planning, budgeting, variance analysis, and efficiency improvements are taking place. In smaller organizations, FP&A managers can sometimes report directly to the CFO.

FP&A managers typically earn a salary between $85,000 and $115,000 annually plus bonuses. The vast majority of FP&A managers have an MBA with 5-10 years of experience.

Senior-Level: Director/VP of FP&A

In larger organizations, there will often be an additional layer between the FP&A manager and the CFO known as the director/VP of FP&A. The director/VP of FP&A will often have 10+ years of experience in a FP&A manager or senior analyst position.

The director/VP of FP&A will typically earn a salary between $100,000 and $250,000 annually with the potential for substantial stock bonuses. This senior-level position and is sometimes a candidate when replacing an organization’s CFO.

Career Path #2: Financial Accounting

Another common career path in corporate finance is within the accounting department. Financial accounting involves recording, summarizing, and reporting a company’s business transactions through the income statement statement, balance sheet, statement of cash flows, and statement of retained earnings. Here is the typical career path in financial accounting:

Entry-Level: Financial Accountant

Financial accountants perform a variety of duties such as maintaining the general ledger, preparing financial reports, reviewing financial statements, assisting with audits, and reconciling accounts.

The responsibilities of a financial accountant differ from those of a general accountant. A financial accountant performs internal accounting duties for an organization, whereas a general accountant often works with external clients.

According to the Bureau of Labor Statistics, financial accountants earn a median salary of $71,550 annually. Financial accountant positions typically require a bachelor’s degree in accounting or finance to be considered for the job. With 5-10 years of experience in financial accounting, it is common to be promoted to a senior accountant position. Senior financial accountants can expect to earn anywhere between $85,000 and $125,000 per year.

Senior-Level: Controller

Controllers are usually the highest ranking accountants within an organization and are responsible for a company’s regulatory and financial compliance. Controllers report directly to the CFO and ensure that money coming in and out of the company is accurately reflected in its ledgers.

Included with a controller’s major responsibilities is a large salary. A controller can expect to earn anywhere between $100,000 and $250,000 per year, with a median annual salary of about $170,000. Controllers often have 10+ years of accounting experience with an MBA and/or a CPA certification. Along with director/VP of FP&A, an organization’s controller is sometimes the candidate when hiring a CFO.

Career Path #3: Treasury

One of the most rewarding career paths in corporate finance is within the treasury department. The main priority of treasury management is to ensure that the cash and financial risks of a business are effectively managed in both the short and long-term. Here is the typical career path in treasury:

Entry-Level: Treasury Analyst

Treasury analysts are responsible for handling the banking transactions of an organization to properly manage cash flow, ensuring that all financial payments coming in and out of a company are processed effectively.

Treasury analyst positions typically require a bachelor’s degree in finance, accounting, or economics and often prefer candidates with 1-2 years of relevant experience including a related internship.

A treasury analyst can expect to earn a base salary of between $50,000 and $80,000 per year with the potential of bonuses, making it a wonderful entry-level career in corporate finance.

Mid-Level: Treasury Manager

Treasury managers oversee a department of treasury analysts and are responsible for managing the day-to-day operations of the treasury department. This includes managing a company’s cash flow in a profitable manner. Treasury managers will report to the corporate treasurer.

Treasury managers expect to earn between $90,000 and $150,000 per year depending on experience. Treasury manager manager positions often require 10+ years of experience and the majority of them have master degrees in finance.

Senior-Level: Corporate Treasurer

Corporate treasurers are the highest ranking position in the treasury department and report directly to the CFO. They tend to focus on the long-term goals of the treasury function, protecting the company from potential financial risks.

The corporate treasurer receives one of the highest corporate finance salaries ranging from $200,000 and $1,000,000 per year. The size of the company will determine which end of the salary scale you will be on. Treasurers employed by a growing multinational company will sometimes be paid millions of dollars per year.

Chief Financial Officer (CFO)

This career guide would not be complete without mentioning the highest position in finance across any organization, the chief financial officer (CFO). The CFO is a senior executive responsible for the financial decision making of a company. The FP&A, financial accounting, and treasury departments all report to the CFO.

Obviously, managing the financial actions of a company comes with an above average salary. In the United States, chief financial officers typically earn over $500,000 in annual total compensation. Through the corporate finance career paths outlined in this guide, becoming a CFO is the ultimate end goal.

Ready for a Career in Corporate Finance?

For those studying finance and accounting, a corporate finance career is an attractive option in terms of a high paying salary paired with a favorable work life balance. For those interested, it is suggested to get an internship while still in college in order to have the highest chance of securing a job post-graduation. Financial planning & analysis, accounting, and treasury all have great entry-level options that are well suited for new graduates.

If you have any questions or comments regarding corporate finance careers, please don’t hesitate to contact us.