Marginal Cost Calculator – Formula & Definition

What is marginal cost and how do you calculate it? Our marginal cost calculator will assist you in computing the cost of manufacturing additional items. Input the change in total cost and the change in quantity below to calculate marginal cost.

Marginal Cost Calculator

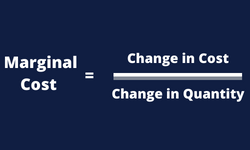

Marginal Cost Formula

Marginal Cost = Change in Total Costs ($) / Change in Quantity

To calculate marginal cost, you divide the change in total costs by the change in quantity. If you are unsure how to find change in total costs, simply subtract current costs by future costs.

Definition – What is Marginal Cost?

In economics, marginal cost is the extra cost associated with producing each additional unit. By calculating marginal cost, you can determine how to optimize production, also known as achieving economies of scale. If the cost of producing an extra unit is lower than the per-unit price, the company has the potential of earning a profit.

Financial analysts use this important concept to help a company optimize its production, and therefore maximize profits. Costs can either be fixed or variable. Fixed costs are typically constant regardless of how many units you are producing; therefore, higher production means that each unit will have a lower fixed cost because the total cost is allocated over more units. Variable costs on the other hand will increase as you produce more units.

Example – How To Calculate Marginal Cost

Pretend Company A manufacturers clocks. Each clock requires $10 worth of materials, primarily plastic and metal. The variable cost of producing each clock is $10. For example, if the company makes 4 clocks, the total variable cost will equal $40.

Fixed costs include rent, salaries, electricity, etc. – any expense that is constant on a month-to-month basis. Company A’s fixed costs are $5,000 per month.

Variable Cost = $10 per unit

Fixed Cost = $5,000 per month

Total Cost = ($10 * Units Produced) + $5,000

Based on this example, if Company A produced 1,000 clocks, its total cost of production would be $15,000, which comes out to $15 per clock ($15,000 total cost / 1,000 units = $15 per unit).

If Company A wishes to reduce the cost per unit and increase profitability, it can produce more units. If it produces 2,000 clocks instead, its total cost of production would equal $25,000, or $12.50 per clock.

Now that you have a general understand of production costs, lets use this same example to calculate marginal cost. By referencing the marginal cost formula above, it can be computed by dividing the change in total costs by the change in quantity. Change in total costs would be $10,000 ($25,000 – $15,000) and change in quantity is 1,000 units.

$10,000 / 1,000 units = $10

Company A’s marginal cost of production is $10.

It is noted that this example left out the possibility of increasing fixed costs. If a company is looking to produce twice as many units, it will most likely need to purchase additional equipment, which would increase fixed costs. Additionally, a company’s variable costs can potentially decrease, due to the fact that many suppliers give discounts if their customers purchase more materials.

How does it Differ From Marginal Revenue?

These two terms often confuse students due to them being very similar in nature. Marginal cost is the cost of producing one additional unit, whereas marginal revenue is the revenue earned from the sale of one additional unit.

Conclusion

The marginal cost calculator helps a company determine what the cost of producing an additional item is. The concept is most commonly utilized in the manufacturing industry, where corporate finance professionals analyze the metric in order to optimize profitability. Depending on the complexity of the business being analyzed, the calculation can get complicated fast.