How to Calculate Tangible Net Worth

When a lender is assessing the credit risk of a potential borrower, they will often utilize an important financial concept known as tangible net worth. Tangible net worth is calculated by subtracting intangible assets from total net worth. What does this mean and why is it important?

Tangible vs. Intangible Assets

Both tangible assets and intangible assets are present on a company’s balance sheet, but what is the difference?

Examples of intangible assets include goodwill, patents, trademarks, franchise costs, and brand names. As you can see, intangible assets are not physical in nature. When a company makes an acquisition of another company, it often pays more than what the net assets are worth on its balance sheet because of other factors, such as the value of a brand name.

Tangible assets are physical. Some examples include cash, inventory, land, vehicles, and equipment. Although accounts receivable is not physical, it is still considered a tangible asset as it can be converted to cash easily unlike a true intangible.

Tangible Net Worth Formula

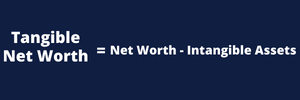

The formula for tangible net worth is simple:

Tangible Net Worth = Net Worth – Intangible Assets

How to Calculate Tangible Net Worth

Although the formula for calculating tangible net worth seems simple, it can sometimes be difficult to calculate in practice. Lenders often have to make their best judgement when determining what is intangible. Let’s go over an example.

Pretend Company ABC has the following balance sheet at fiscal year end:

Assets:

| Cash | $50,000 |

| Inventory | $75,000 |

| Accounts Receivable | $25,000 |

| Vehicles | $110,000 |

| Goodwill | $40,000 |

| Total Assets: | $300,000 |

Liabilities:

| Accounts Payable | $30,000 |

| Long-Term Debt | $200,000 |

| Total Liabilities: | $230,000 |

As shown above, the borrower has total assets of $300,000 and total liabilities of $230,000. Net worth is calculated by subtracting total liabilities from total assets.

Net Worth = Total Assets – Total Liabilities

Net Worth = $300,000 – $230,000

Net Worth = $70,000

Now that we know net worth, we must now figure out if there are any intangible assets on the balance sheet. Since goodwill is considered an intangible asset, it needs to be subtracted from net worth in order to calculate tangible net worth.

Tangible Net Worth = Net Worth – Intangible Assets

Tangible Net Worth = $70,000 – $40,000

Tangible Net Worth = $30,000

Importance in Banking

It is easy to see why a lender might want to exclude intangible assets from net worth when calculating leverage and other import ratios. Banks use tangible net worth to determine a company’s “actual” net worth rather than one that is inflated to account for things that aren’t really there.

In commercial lending, financial covenants that test tangible net worth are common. This allows the lender to evaluate a borrower’s ability to settle its debts.