How To Calculate Gearing Ratios

Gearing ratios are a group of financial ratios that are used to assess a company’s leverage and financial stability. What are the gearing ratio formulas and how do you calculate them? The four gearing ratios include:

Gearing Ratios Explained

Companies have to raise capital to fuel their operations, expand into new markets, finance top research and development, and outperform the competition. The amount of capital needed to facilitate and achieve a corporation’s objectives often requires external funding.

The three major sources of capital are retained earnings from a firm’s operations, debt financing, and equity capital. Great care should be exercised when borrowing to ensure financial stability, especially in adverse market conditions. Performing gearing ratio analysis can help monitor how prepared the company is to meet its debt repayment obligations.

Gearing measures the debt used to finance the underlying firm’s operations versus the shareholders’ capital received. A high gearing ratio indicates a high proportion of debt to equity, whereas a low gearing ratio shows a low proportion of debt to equity.

Company’s should regularly keep an eye on their gearing ratios, especially when making future capital model decisions. Lenders look at gearing ratios when assessing the risk profile of a potential borrower.

Debt-To-Equity Ratio

The debt-to-equity ratio is the most common type of gearing ratio used by banks when assessing a company’s leverage position. The debt-to-equity ratio is computed by dividing the total debt by shareholders’ equity, as shown below. Every industry is different, but in general a debt-to-equity ratio under 1 is favorable because it means the company in question has more equity than debt.

Debt-To-Equity Formula

Debt-to-Equity Ratio = Total Liabilities / Total Equity

Debt-To-Equity Example:

Pretend this is the balance sheet of the company you are analyzing:

| Total Assets | $1,000,000 |

| Total Liabilities | $400,000 |

| Total Equity | $600,000 |

With total liabilities of $400,000 and total equity of $600,000, the debt-to-equity ratio would calculated as follows:

$400,000 / $600,000 = 0.67x

The company’s debt-to-equity ratio is 0.67x, which is considered unleveraged.

A lower debt-to-equity ratio implies a more financially stable entity. A company with a high debt-to-equity ratio is considered risky by investors and lenders. A company leveraging high amounts of debt may struggle to repay them.

Times Interest Earned (TIE) Ratio

The times interest earned ratio is used to determine a company’s ability to generate enough profit to settle its existing interest payments over a given period. It shows the number of times a company can pay its interest expenses if it dedicated all of its earnings before interest and tax to it. It aids in determining a company’s profitability of default.

A high times interest earned ratio means a firm has low profitability of default, making it a good investment for lenders. Very high times interest earned ratio, however, shows the company is holding gains and not reinvesting.

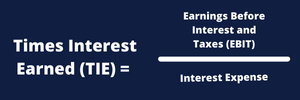

Times Interest Earned Formula

Times Interest Earned Ratio = Earnings Before Interest and Taxes (EBIT) / Interest Expense

Where EBIT is profit earned by the business without factoring in interest or tax payments and interest expense is the interest portion of debt payments made to creditors.

Times Interest Earned Example

Pretend that a company’s income statement looks like this for the most recent fiscal year:

| Total Revenue | $1,000,000 |

| Operating Expenses | $600,000 |

| Interest Expense | $50,000 |

| Taxes | $100,000 |

| Net Profit After Tax | $250,000 |

First, you need to calculate EBIT. Take net profit and add back interest expense of $50,000 and taxes of $100,000.

EBIT = $250,000 + $50,000 + $100,000 = $400,000

To calculate times interest earned, simply divide EBIT of $400,000 by interest expense of $50,000.

$400,000 / $50,000 = 8 times

Generally, a company that has a times interest earned ratio greater than 2.5 is considered an acceptable amount of risk to creditors and investors.

Equity Ratio

The equity ratio measures how much leverage a company is using by looking at the amount of assets that are financed by owners. It will tell you how well a business manages its debts and funds its assets.

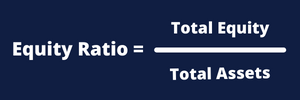

Equity Ratio Formula

Equity Ratio = Total Equity / Total Assets

Equity Ratio Example

Pretend this is the balance sheet of the company you are analyzing:

| Total Assets | $1,200,000 |

| Total Liabilities | $500,000 |

| Total Equity | $700,000 |

With total equity of $700,000 and total assets of $1,200,000, the company’s equity ratio would be calculated as follows:

$700,000 / $1,200,000 = 0.58x

Generally, a company with an equity ratio of less than .50 is considered a leveraged firm. Leveraged companies pay higher interest rates on loans while conservative companies advance more dividends to shareholders.

A higher equity ratio is a good sign for a company. This means a high return on investment by shareholders, giving potential investors the confidence to invest in the underlying company. A high equity ratio also convinces lenders that the firm is sustainable and can guarantee future loan repayments. Equity financing is generally cheaper than debt financing due to the high interest rates charged on loans.

Debt Ratio

The debt ratio is another leverage ratio that banks and investors use when analyzing a company’s balance sheet. It shows a company’s total liabilities as a percentage of its total assets.

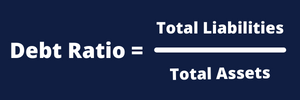

Debt Ratio Formula

Debt Ratio = Total Liabilities / Total Assets

Debt Ratio Example

Pretend this is the balance sheet of the company you are analyzing:

| Total Assets | $1,400,000 |

| Total Liabilities | $900,000 |

| Total Equity | $500,000 |

With total liabilities of $900,000 and total assets of $1,400,000, the company’s debt ratio would be calculated as follows:

$900,000 / $1,400,000 = 0.64x

Generally, a good debt ratio is anything below 1.0x because it means the company has more assets than liabilities. A debt ratio above 2.0x indicates a company has twice as many liabilities as assets and would be considered more risky to a creditor or investor.

Why Are Gearing Ratios Important?

Gearing ratio analysis is important to several different parties. It’s important for management when evaluating their company’s performance, goal-setting, and decision-making. Creditors analyze gearing ratios when determining the risk level of prospective borrowers and deciding interest rates charged on their loans. Investors use gearing ratios when examining the potential of a firm’s dividend payments. A company with stable gearing ratios will naturally attract more investors and lenders.