What is a Standby Letter of Credit? – How it Works & Examples

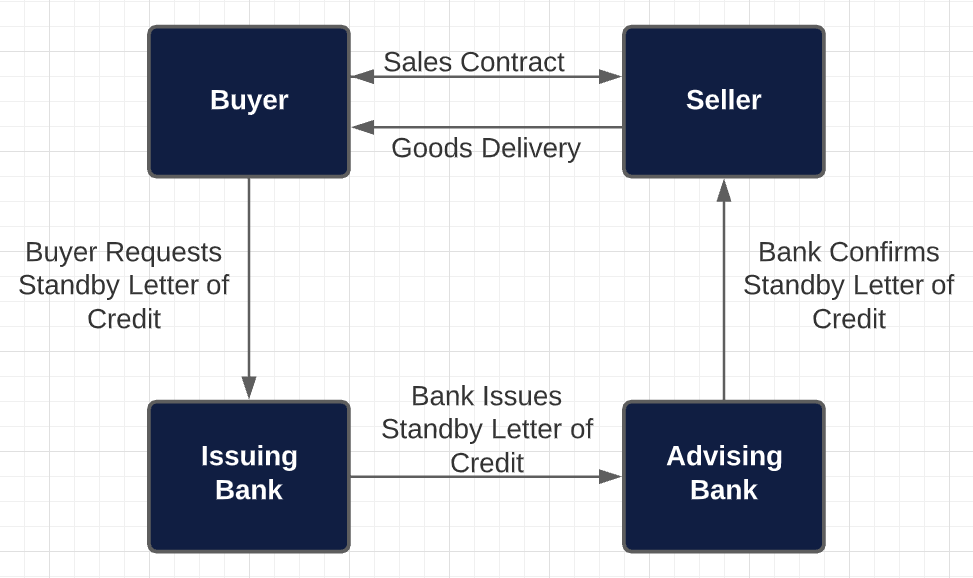

A standby letter of credit (SBLC) is a legal instrument issued by a bank. It represents the bank’s guarantee to make payment to the seller of a certain amount in the event the buyer is unable to make the payment themself as agreed.

A standby letter of credit is frequently used in international trades. Businesses normally use it to secure overseas contracts especially when the parties concerned are unfamiliar with each other. This allows the risks of non-payment or non-delivery to be mitigated.

Getting a standby letter of credit requires the buyer to go through a similar process as getting a loan. The bank will need to perform its due diligence on the buyer before it can issue the standby letter of credit. Things the bank checks include the buyer’s credit history, credit report and so on.

In some cases, the bank may ask the buyer to provide collateral as a condition for approval. The collateral could be a piece of property or in the form of cash, depending on the buyer’s cash flow condition, the amount guaranteed in the standby letter of credit and the associated risks.

After the standby letter of credit has been approved, the buyer’s bank will then notify the seller’s bank to inform the seller’s bank of this standby letter of credit. To do so, the buyer will have to provide his bank with the seller’s personal and bank details and the type of documents required for payment.

If there is anything unanticipated that stops the buyer from completing the payments to the seller as planned, a standby letter of credit will help ensure that such payments are still made after the seller has performed their obligations as agreed, for example, the seller has provided the goods or services to the buyer as agreed.

In such cases, the seller will have to show proof that they have performed the obligations based on the type of documents listed in the standby letter of credit within a stated timeframe. Once all conditions are met, the buyer’s bank will release payment to the seller’s bank.

What is the Difference Between a Letter of Credit and a Standby Letter of Credit?

These two instruments are issued by the bank at the buyer’s request. They are both widely utilized in international trade. The differences between them are as follows:

1) Purpose

A letter of credit is used by the buyer as the primary means to make payment for a transaction while a SBLC is only used when the buyer is unable to make payment itself. Usually, the buyer will try to avoid using a standby letter of credit unless they are forced to due to some unforeseen events, such as cash flow problems.

2) Features

There is no criteria to be met in a letter of credit for the payment to be made. But this is not the case for a SBLC. As mentioned above, the buyer has to tell their bank the type of documents required from the seller in the case that the bank needs to help pay on the buyer’s behalf.

3) Cost

A letter of credit is cheaper, costing 0.75% – 1.50% of the amount covered, while a SBLC is more expensive, costing 1% – 10% to cover the same amount.

4) Period of Time

A letter of credit is for a shorter period, normally up to three months, while a SBLC is usually for a longer period, which could be up to a year.

Advantages of a Standby Letter of Credit

A standby letter of credit has many benefits, which are as follows:

- It instils trust in the seller by protecting them against non-payment by the buyer.

- The buyer will also feel safe as the seller must adhere to the standby letter of credit’s requirements, such as a performance clause, to get paid.

- It demonstrates the buyer’s creditworthiness and capacity to pay in the case of a default.

- It aids in the development of trust between the buyer and seller as well as the reduction of risks.

Different Types of SBLCs

Here are some common examples of how a standby letter of credit is used:

1) Performance SBLC

A performance-based standby letter of credit is normally given to a contract’s third party as an assurance that a job will be completed on time. In the event where the bank’s customer fails to fulfil the job within the timeframe stated in the SBLC, the bank will refund a certain amount of money to the contract’s third party.

This is commonly utilized when a job must be completed within a set time frame. It is given to the contract’s third party as compensation for any inconvenience caused by the delay in the job’s completion.

2) Financial SBLC

This is one of the most common ways a standby letter of credit is used. It is used to ensure that products or services are paid for based on the terms of the contract.

For instance, Company A delivered 2,000 chairs to Company B based on their agreement but Company B fails to make payment within the agreed timeframe. Company A can then use the standby letter of credit to recover the payment for the chairs from Company B’s bank.

3) Tender Bond SBLC

At the request of its customer, the bank that issues the standby letter of credit can include certain terms in the SBLC based on the situation involved and the purpose of the SBLC. For example, a business can request all its bidders to submit tender bond standby letter of credits which prevent them from withdrawing their bids until the completion of the tender.

4) Advance Payment SBLC

A standby letter of credit can also be utilized to shield the buyer from any default or non-fulfilment by the seller and lower the buyer’s risks. Instead of making a full down payment in cash, the buyer can use a standby letter of credit to pay in full or just a part of it.